Colliers - In 2025, India's Office Leasing Activity crosses 70 million sq. ft. Mark.

Colliers - In 2025, India's Office Leasing Activity crosses 70 million sq. ft. Mark.

Colliers - In 2025, India's Office Leasing Activity crosses 70 million sq. ft. Mark.India’s commercial property segment experienced upward growth momentum in 2025. Colliers India reports that office leasing in top Indian cities exceeds 70 million sq. ft. For the first time, India’s commercial real estate witnesses a strong sentiment and steady growth. The five-figure mark crossing incorporated demand for Grade ‘A’ premium workspaces.

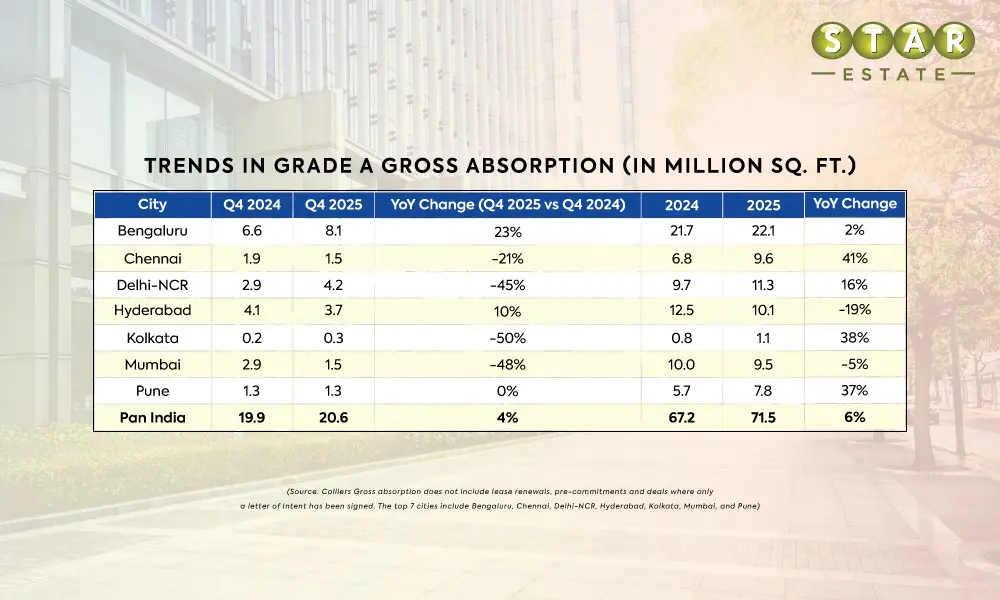

Office leasing stood at 60 percent YoY (Year-on-Year Increase) with 71.5 million sq.ft in 2025. The year’s last quarter (Oct-Dec) plays a pivotal role as demand for office spaces leasing grew to 20 million sq ft. mark. It is more than the earlier quarter, reflecting the closure of large-ticket size deals and business expansion sentiment.

In 2025, Bangalore earned one-third of the office space leasing, the largest portion of the pie of 22.1 million sq.ft. Following India’s silicon city is Delhi-NCR, Hyderabad, Chennai, and Mumbai, with contributions to activities of 13-16 per cent. This growth indicate zest for business expansion across tier I cities.

City-based contribution in India’s Office Space Leasing

The final quarter of 2025 witness highest-ever leasing in a quarter with 20.6 million sq.ft. Bangalore ranks first in the leader board 8.1 million sq.ft. Followed by the Delhi-NCR region at 4.2 million sq.ft. Both cities account for 60 per cent of the total leasing in the quarter.

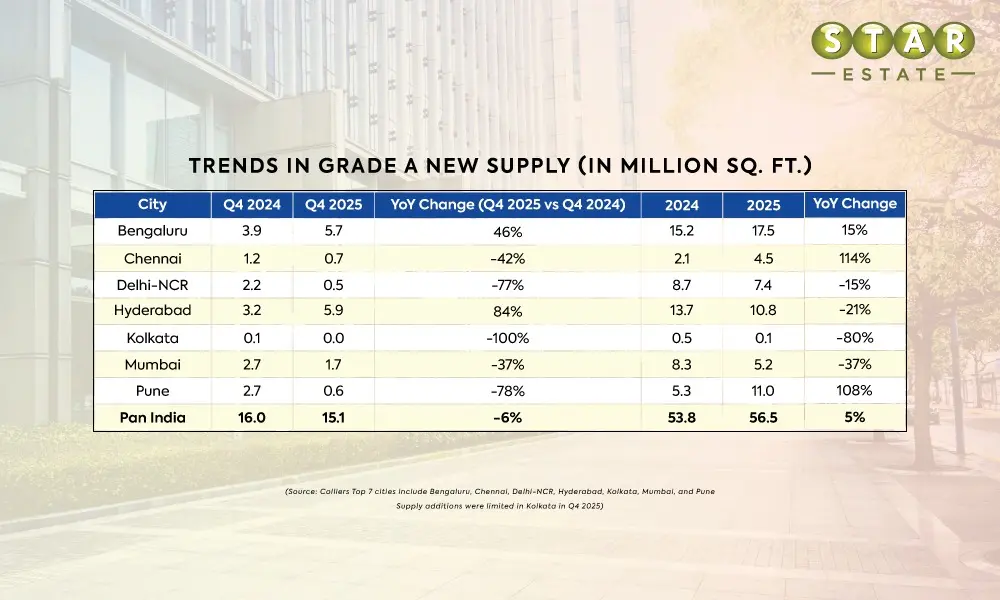

2025 witnesses the completion of new office structures in the top Indian tier I cities at a steady 56.5 million sq.ft. It is 5 per cent higher than the previous year, 2024. Bangalore, Hyderabad, and Pune added to the supply chain by adding 10 million sq. ft., new structure completion, respectively. They combinely calculate 70 percent of the yearly supply.

The average vacancy level dropped by 49 basis points, and average rental ascends by 15 percent Year on Year basis. It is a reflection of high office space demand balanced by a steady supply of immovable assets.

The IT sector had the highest ask for office space demand, with a tally of 37 per cent of conventional office leasing in 2025. In the year, conventional office space totalled nearly 58.5 million sq. ft., out of which tech sector leases approximately 22 million sq. ft., alone. It reflects a 32 per cent Year-on-Year increase.

BFSI, engineering, manufacturing, and consulting companies’ together account for 40 percent of conventional leasing. It is mainly based on broader demands in distinguished sectors.

Workspace Expansion and Global Capability Centers steer growth in Leasing Activity

The demand for flexible workspace kept growing, with a leasing of approximately 13 million sq. ft. of Grade ‘A’ office space records higher than 2024. The year 2025 witnessed flexible office space leasing for approximately 18 per cent. The activity was led by Bangalore and Delhi NCR. A similar strong sentiment was seen in Pune and Chennai.

GCCs (Global Capability Centers) become the key drivers of growth in demand for office space leasing. As several GCCs demand tallies for 40 per cent of the total office space in 2025. In the year, GCCs clocked at 30 million sq.ft. space as India’s skilled talent acts as an ancillary to the sector.

The Future Ahead

According to Colliers India, the Indian real estate market looks optimistic in 2026 with strong support from GCC and business expansion. The demand for qualitative and sustainable office spaces from BSFI and other industries will continue to grow in top-tier I cities.

Reforming Land Policies can ma...