RBI Monetary Policy – Unchanged Repo Rate, Relief to Homebuyers; boost to Real Estate

RBI Monetary Policy – Unchanged Repo Rate, Relief to Homebuyers; boost to Real Estate

RBI Monetary Policy – Unchanged Repo Rate, Relief to Homebuyers; boost to Real EstateReserve Bank of India, in its first policy meeting after the Union Budget 2026, kept the repo rate unchanged at 5.25%. Sanjay Malhotra, RBI Governor, said that the decision was taken considering strong fiscal growth and the unburdening of tariffs after the trade agreement with the United States of America.

The first RBI MPC in 2026 seeks relief for middle-class taxpayers puzzled over whether banks will cut home loan interest rates. The decision to continue the current Repo rate by the RBI is taken in a two-day Monetary Policy Meet, a bi-monthly procedure. It aims to monitor and bring necessary alterations to ensure a robust financial strategy for the nation.

Unchanged RBI repo rate to impact India’s race to become the world’s third-largest economy? Looking at the current growth, it seems neutral. Sanjay Malhotra, RBI Governor, said the decision to continue no change pattern is repeated as the country remains on a growth trajectory. Therefore, the retention is “neutral,” and rates will continue to be on the lower edge for some time.

According to the Economic Survey, in the present financial year, India’s growth expectancy stands at 7.4%. It follows next year's growth prediction between 6.8% and 7.2%.

Unchanged Repo Rate – How it effect Home buyers

Stable EMIs

The unchanged repo rate at 5.25% exhibits a stable interest rate on home loans, therefore, maintaining the current EMI value. A big relief for existing home loan borrowers after the RBI Monetary Policy 2026 meeting. No immediate change in EMIs will occur as no policy change comes into effect for floating rate home loans, linked to the RBI repo rate.

The non – alternation to interest rate will bring steadiness to affordability and empower homebuyers to save more.

Effective EMIs

For new home loan borrowers, the unchanged RBI repo rate will mean budget-friendly loan EMIs. Not much short-term benefits, but the controlled home loan lending rates between 7.3% and 8% support the property ownership dream.

A broader Outlook – Unchanged Repo Rate and Real Estate Business

The steadiness in repo rate boost homebuyer’s confidence and thus reflects positively on residential real estate. It is also an encouragement to explore easy finances, as home loan borrowers can explore options. Including a change of lender, shortening home loan tenure, and increasing EMI values. Therefore, the first RBI Monetary Policy after Budget 2026 lays optimistic energy for developers, end-users, and investors.

Why RBI Repo Rate remain unchanged after December 2025?

While experiencing relief for no hike in home loan EMI, the decision to keep the RBI repo rate unchanged raises many concerns. Reserve Bank of India, in its first MPC meeting of 2026, announced no change and continuation of 5.25% RR (Repo rate). The decision to pause the change in the repo rate since last year depends on several factors.

Robust Growth

On the estimated account of 7.4% GDP growth in FY2026-27, the RBI in its two-day MPC holds a change in repo rate. The GDP growth with the India-US Trade Agreement as an aid will strengthen the economy, thus eliminating the immediate need for policy revamp. Also, the Reserve Bank of India aims to maintain flexibility to alter policy for the future, considering the constant fluctuation in geo-political scenario.

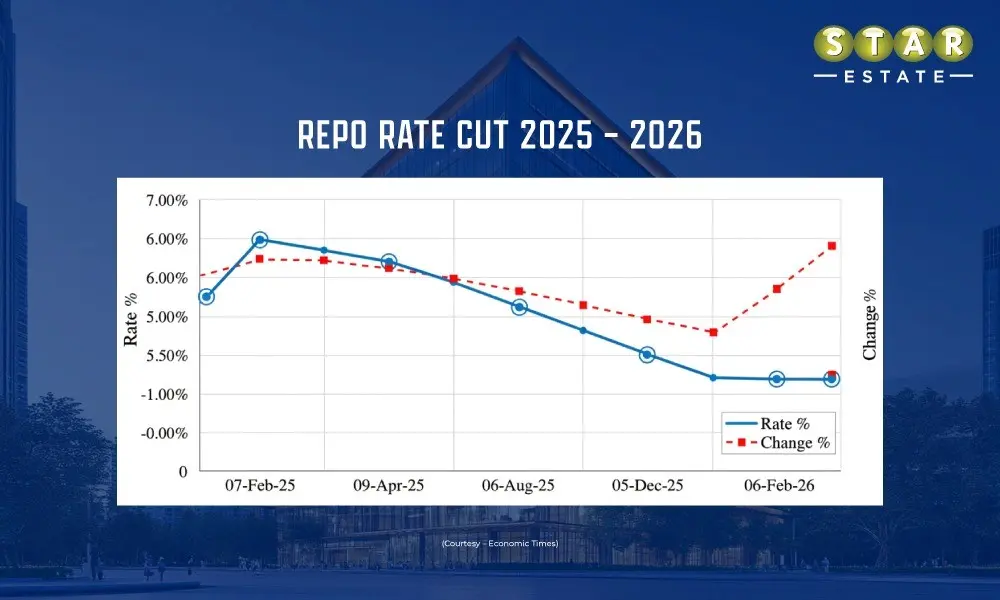

Satisfactory Rate Cut in 2025

A massive slashing of 125 basic points in 2025 supports an unchanged RBI repo rate in 2026. The previous cuts are ancillary to liquidity, thus making the real estate business one of the best investment options in India. The steady repo rate boosts homebuyers’ confidence, thus expecting an upward movement in the demand for housing units.

Impact of Unchanged Repo Rate – Luxury vs Affordable Housing

Will banks lower home loan interest rates after the announcement of the RBI MPC to keep the repo rate unchanged in Q1, 2026?

After witnessing a slashing of over 100 basic points earlier in 2025, the nation witness consecutive pause in the repo rate. Therefore, increasing interest of investors and first-time homebuyers in non-liquid assets. On the sides of income rise and oscillation in global political situations, now is a good time to buy property in India. As a result, all segments of residential real estate in India are witnessing high demand.

The unchanged RBI repo rate in 2026 is positive news for Indian real estate. The feasible home loan EMIs predicts surge in demand for affordable and luxury residences.

Luxury Housing to gain momentum after RBI MPC 2026 Announcement

The demand for housing inventory will soar in top Indian cities, including Delhi and Mumbai, followed by a stable repo rate. The lower home loan EMIs will act as a catalyst for investments in immovable assets. The premium project values, demand, and possibility for capital gains will lure native, NRIs, HNIs, and even end-users to the property market.

Affordable Housing to Increase after no hike in home loan Interest Rate

The neutral stance, as RBI Governor Sanjay Malhotra said, the less valued home loan EMIs, will strengthen home buying sentiment. Thus, first-time buyers in tier I and II cities will step into the market. Interestingly, smaller cities will witness a rise in demand for housing.

Road ahead for Indian Real Estate | RBI Monetary Policy 2026

Indian real estate, while being hopeful for an eventful year, eyes the next bi-monthly RBI Monetary Policy Meeting. The next MPC 2026 will take place in April and might introduce a change in the RBI repo rate after a long pause since December 2025.

RBI Framing Guidelines for Ban...