Fractional Ownership Explained – A Rising Investment Toolkit in Indian Real Estate

The Indian real estate market is shining brighter than ever with its transformative realm. Amidst this, fractional ownership in India has become a popular choice for investors. The smaller investment budget, asset creation, and stable return formula grab attention. According to a report published in Business Standard Tier I cities are best to reap passive income through fractional ownership.

Fractional Ownership Explained – A Rising Investment Toolkit in Indian Real Estate

Fractional Ownership Explained – A Rising Investment Toolkit in Indian Real Estate What is Fractional Ownership?

Fractional ownership is a getaway for mid-segment investors to explore luxury real estate. Under its umbrella, an immovable asset acts as a share, where it has multiple owners. Interestingly, the return on investment on the same is also shared as a dividend. Thus, it is one of the best modern real estate investment options to explore.

Journey of FoP – Fractional Ownership Platforms

Fractional ownership in India gained momentum through SM REIT, i.e., Small and Medium Real Estate Investment Trust. If you wonder whether REIT and SM REIT are different, then here is the answer. No. They aren’t distinct, but SM REIT is a branch of REIT. (REIT – Real Estate Investment Trust) and SM REIT (Small and Medium Real Estate Investment Trust).

- Introduced in 2014, FoP (Fractional Ownership Platform) was limited to only an asset of INR Rs. 500 Crore.

- However, in 2023, the consultation paper introduced Micro, Small, and Medium REITs with an asset value of INR 50 Crore – INR 499 Crore.

- In June 2024, the frequently asked questions (FAQs) released by SEBI (Securities and Exchange Board of India) brought in more transparency.

- Following which, in August 2024, the maiden SM REIT was registered with five applications being under process.

Types of Fractional Ownership in India

Being a new real estate investment option in India, investors are quite apprehensive about fractional ownership. However, the clear guidelines and FAQs support from the Securities Exchange Board of India (SEBI), let developers offer the best property investment options in 2025. Here are the top portfolios to invest in fractional ownership in India.

Office Spaces

The investment option is not limited to premium Grade ‘A’ offices. In fact, low-budget office spaces are also part of SM REIT. The addition of these spaces offers a budget-friendly investment option.

Co-Working Spaces

Such spaces are either owned or leased for reaping high rental and sub-lease value.

Holiday Homes

Under fractional ownership, it is one of the best options for investment. The demand for vacation homes at tourist destinations is a popular property investment option in 2025, thanks to the massive footfall. With the rise in demand for vacation homes over hotel stays, an investment in fractional property is a wise decision.

Retail Shops

Even in bigger cities, investment in commercial properties requires for hefty amount. Thus, fractional ownership in India makes premium property investment easy like never before.

Warehouses

The rise in 3rd party warehouse providers offers logistic support across industries. However, these high-value properties aren’t a feasible investment option for many investors. But the fractional real estate model does make it one for not only country-based investors, but also for NRIs and HNIs.

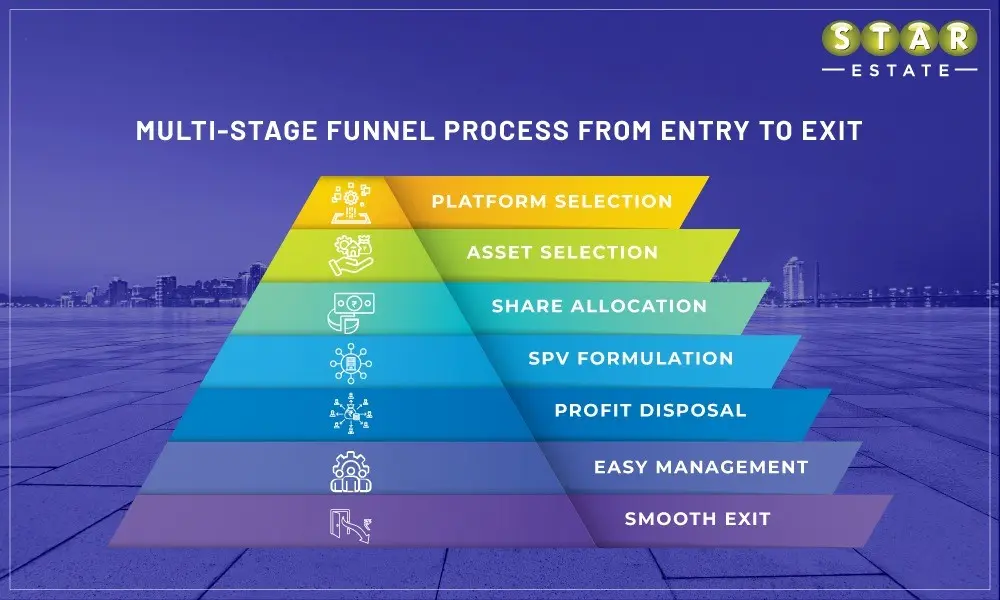

How Fractional Ownership Works

Being a contemporary investment option, many think twice about why to invest in fractional property. Or is it even safe to bet on modern real estate investment options over traditional methods? The answer is yes, it is a new but cost-effective way to reap income from investment. Thus, here is a detailed understanding of how fractional ownership works in the real estate market.

Platform Selection

The first step to investment is the search for a reputable online platform that offers fractional ownership in India. How to find the best platform for fractional ownership is the question you have? Then, here is the answer. Conduct online research and shortlist the relevant options. Then, check for their previous business and client testimonials. Do assess if they comply with the norms set by SEBI (Security and Exchange Board of India) or not.

Asset Selection

Once a platform is chosen, delve deep into the diverse portfolio of residential, commercial, and mixed-use immovable assets. Evaluate your budget and select the best option by keeping certain things in mind. Check for location, amenities, and safety standards to reap maximum benefit from shared property ownership.

Share Allocation

Being one of the best real estate investment alternatives in 2025, the property sharing concept in India works on the share market model. Thus, an immovable asset is segregated into shares starting from five percent.

SPV Formulation

Unlike regular property ownership, SPV, i.e., Special Purpose Vehicle, is formulated to take investors as shareholders on board. Either it can be via LLP, i.e., limited liability partnership. The partial or low-risk mitigation via LLP grabs the attention in fractional ownership in India.

Profit Disposal

Post deduction of management fee, the rental value or capital gains is distributed amongst shareholders as per their share value.

Easy Management

Invest and reap profitability from the real estate investment option in a hassle-free manner. The platform manages immovable assets, including maintenance, tenant verification, and rental collection.

Smooth Exit

The real estate fractional investment has a lock-in period, after which the investor can sell her/his share and reap abundant profitability.

Income Tax and Fractional Ownership in India

Fractional ownership in India is also taxable. Here are the things to consider about tax on shared property ownership.

Rental Income

A 30% standard deduction is applicable on maintenance under the Income from House Property.

Depreciation Benefits

If the property is owned under an LLP (Limited Liability Partnership), then certain deductions are applicable on the same.

Capital Gains

The gains from the sale of ownership are subject to Special Purpose Vehicle and tenure, thus it may also attract sum tax.

TDS (Tax Deduction at Source)

Rental income from the fractional property is subject to TDS in case the value for the same exceeds a certain level.

Benefits of Fractional Ownership

There are several benefits of property investment in India. Interestingly, now is the best time to invest in property. The real estate fractional investment in India allows investors to own premium immovable assets in a budget-friendly manner. With SEBI regulations in place, these investments become a way to wealth creation for property investors.

Easy Affordability

The basic property price start from Rs. 10 lakh and Rs. 25 lakh for premium immovable assets. These prices distinguishes from project sizes to their locations.

Diversification

With the pan Indian investment option, investors can reap maximum passive income through potential ownership. Also, by the sale of fractional ownership one can enjoy lucrative capital gains. However, tax implications on the same will reflect in case of value over certain budget-bracket.

Capital Appreciation

The altercation in property prices and continuous infrastructure development in reflects in higher capital appreciation. It is a primary reason for investors, HNIs and NRIs to explore the best real estate investment alternatives in India.

Consider these reasons to explore the best real estate investment option in 2025 which holds the key to financially secure future.

You May Also Like: Why Top Tier-II Cities source best Real Estate Investment Options in India

You May Also Like: Real Estate Investment – A Road Map to Retirement Planning

India-US Trade Deal – Is it a ...