India-US Trade Deal – Is it a Tailwind for Real Estate in India?

In February’s first week, the India-US Trade Agreement 2026 becomes the blueprint for bilateral growth. An interim pact with a half-tariff rollback is seen as an initiative to strengthen ties between the two nations. Exactly, after a year of tariff tussle, the decision of overall $500 billion business is likely to boost real estate in India.

India-US Trade Deal – Is it a Tailwind for Real Estate in India?

India-US Trade Deal – Is it a Tailwind for Real Estate in India?

Table of Contents

Post imposing a 50 percent punitive tariff, Donald Trump’s move to roll back the same to 18 percent came as a surprise. The decision was taken after a telephonic conversation between US President with PM Narendra Modi, where India exhibited its determination for strategic autonomy. The end of the tariff war with the reciprocal tariff policy by New Delhi aims to boost bilateral trade.

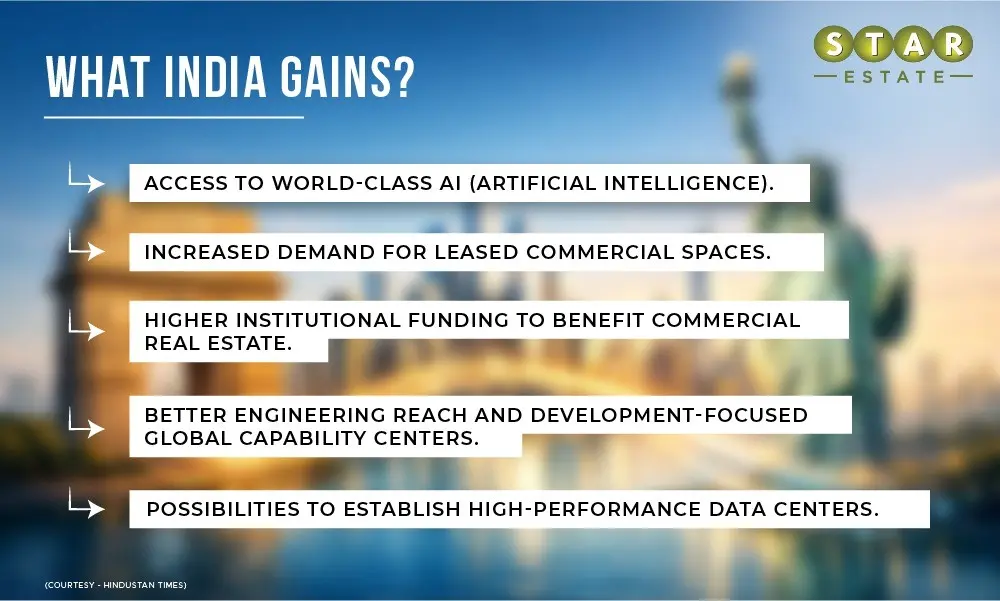

As India gears up for a $500 billion business with the United States of America, sector-specific commitment will have positive outcomes. In the contour of this pact, India’s technological sector gains many future-ready reforms.

India US Trade Deal and FDI | Understanding Economics

India US Trade deal is more than economic. Piyush Goel, Union Minister for Commerce and Trade, India, said the nation will attract higher value investments. Artificial Intelligence is laying a strong foundation for high-performing data centers and Global Capability Centers (GCCs) in India.

The steady Indian currency and India’s export chain expansion to the US make investors confident. Thus, a strong boost to US FDI in Indian real estate is likely to push commercial real estate in India.

JLL, a reputed consultancy firm, feels multiple factors will push forward the Indian real estate. “Indirectly, the benefits on India’s real estate market are undeniable. Lower trade tensions and a strong currency support capital inflows and foreign investment confidence, which historically helped commercial and residential property markets. Conversely, without such an agreement, tariff-related exports stress had risked slowing broader economic growth, potentially, dampening demand in the price-sensitive real estate sector,” said Samantak Das, Chief Economist and Head of research and REIS, India, JLL.

India US Trade Deal and its Impact on FDI Investment in Real Estate in India

The curtailing of punitive tariffs, lower fluctuation in real estate, open doors for US FDI in Indian real estate.

“The commercial real estate sector is expected to benefit from higher global institutional funding. Lower tariffs could boost manufacturing-led businesses, while rising exports are likely to attract engineering research and development-focused global capability centers, driving increased demand for leased commercial space” said Das, Chief Economist and Head of research and REIS, India, JLL.

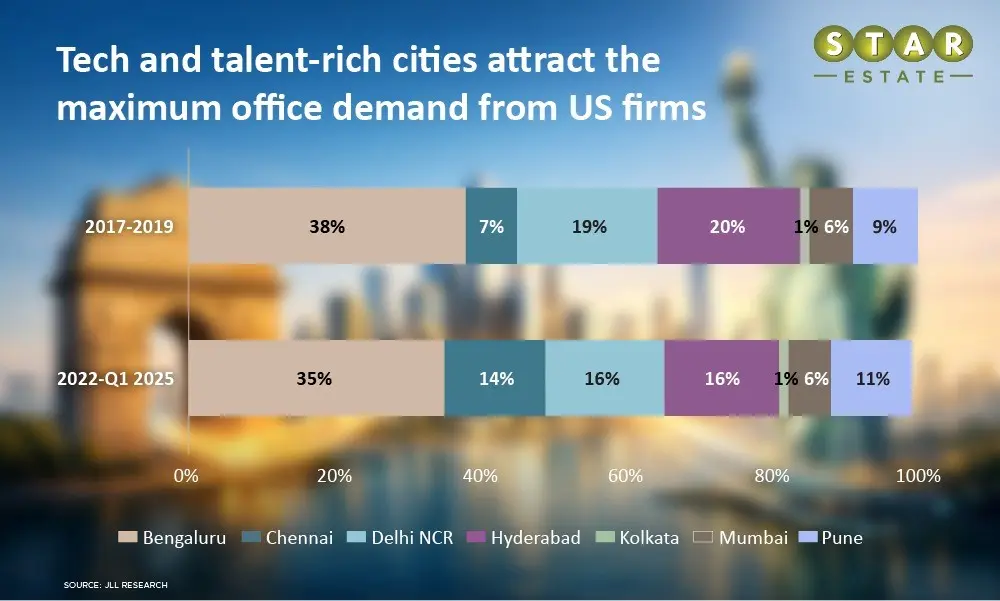

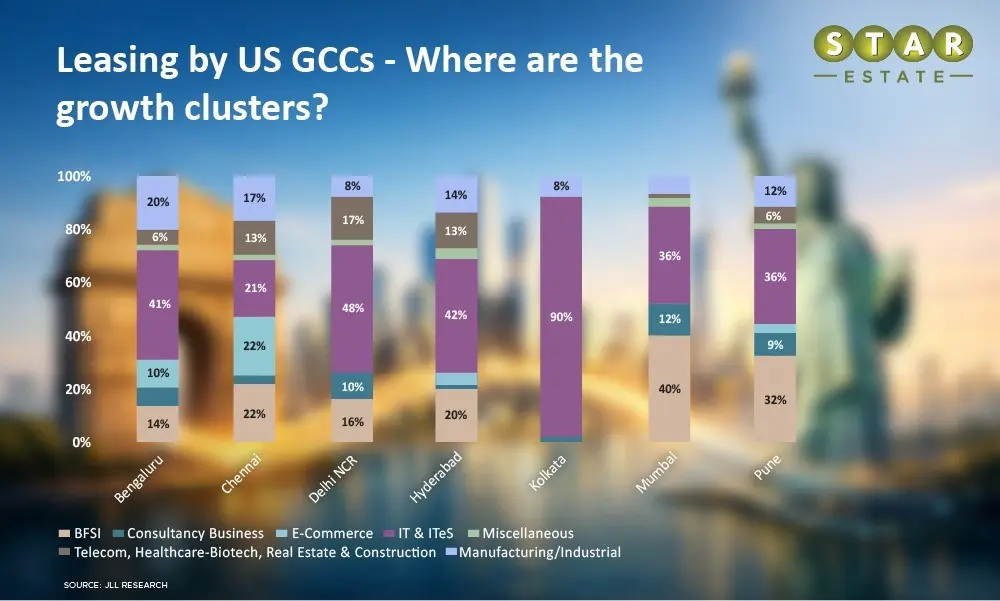

The higher-institutional funding will accelerate the establishment of modernly functional commercial properties. Thus, increasing demand for leased commercial spaces in the country. The major beneficiary from FDI in Indian real estate via the India-US trade deal will include Bangalore, Mumbai, Hyderabad, and Delhi-NCR.

You May Also Like: Looking for Long-Term Investment Options?

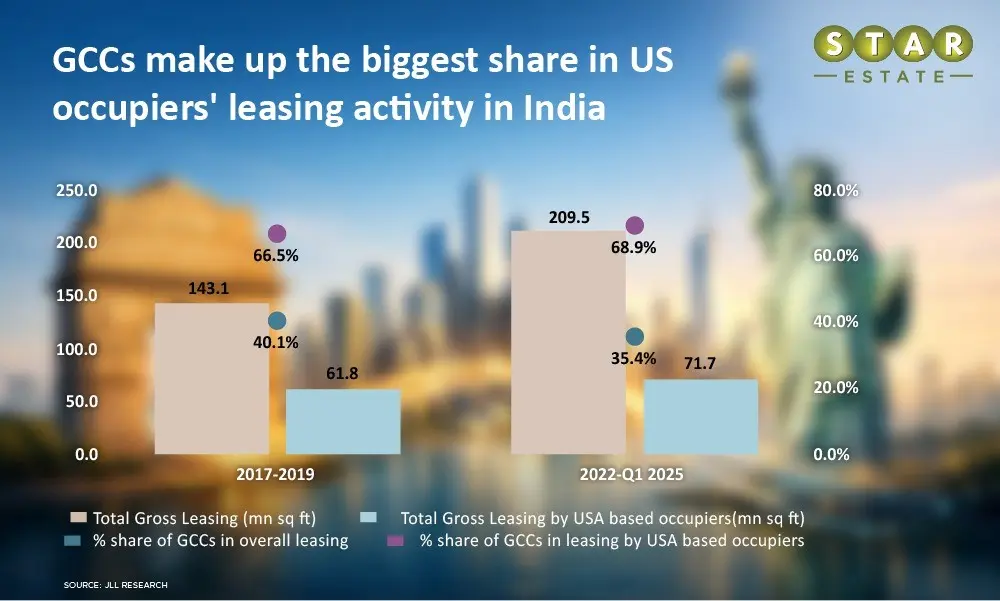

Over the past five years, American-based investors have been making their presence felt in real estate in India. According to the JLL report, US-origin firms account for 34.2% gross office leasing activity in India in 2022.

Despite not much activity happening in 2025 it marked high investments with higher number prior to American investors in year 2024 for office space leasing in India. Therefore, US FDI in Indian real estate is predicted to gain better mileage in the coming times.

Along with other industries, including textile and gems, India’s property sector is likely to experience bonafide growth. India’s purchase of data center equipment from the United States will raise the quality of workplaces and GCCs. Therefore, a strong push for leasing and investment from American investors will render India US trade deal benefits to real estate in India.

American-Investors in Real Estate in India | Strengthen New Delhi-Washington Ties

Indian real estate hosts diverse occupiers mainly from the United States of America. The US investors in Indian real estate maintain more than two-thirds share in overall leasing activity in India. It is a steady sectoral trend in leasing activity in GCCs (Global Capability Centers) in India.

The experts are optimistic about India US trade deal being a positive game-changer for FDI in Indian real estate. Considering the American investors as the majority occupiers of office space in the country since 2022 –Q1 2025. Interestingly, commercial real estate will continue to rise, as US investors prefer investments in GCCs.

You May Also Like: Why is it a Good Time to Invest in Bangalore?

How does US FDI in Indian Real Estate push India’s Economic Growth?

New Delhi locks lowest tariff rate for any Asian country with the United States of America in the recent India-US trade deal. The detailed agreement, likely to take shape in March, has already shown signs of better days ahead for real estate in India.

With the trend of investment in Indian real estate, American-based investors applaud preferential market access. The lower the tariff is, the lower the uncertainty in business is. US-based investors are escalating Indian investment in the commercial segment by over 60 percent.

What stood at 1.6 billion in 2024, values 2.6 billion in 2025, Hindustan Times, a leading news publication, report. The alterations in FDI policy and RBI forex dump of $690 billion create an ecosystem for bilateral trade. India, being a young nation, is also a catalyst for a Global Investment Hub with integration in GVC (Global Value Chain), which will boost investment in real estate in India. The inflow of technology and commercial resources is expected to bring in the much-needed reforms.

India US Trade Deal Benefits for Real Estate in India

- Rise in institutional investments as manufacturing and exports soar, thanks to lower tariffs.

- The lowered input cost, reflecting cheaper steel, will move the residential real estate market upwards.

- Strong buyers’ confidence via a robust economic situation will result in property investment.

- Diversified portfolios and CRE (Commercial real estate) will draw significant cash flow.

- Better investment opportunities for NRIs and foreign entities to invest in Indian real estate.

The Road Ahead – FDI in Indian Real Estate

The India-US trade deal opens distinguished avenues of possibility majorly for real estate in India. The nation, currently with a $4 trillion economy, aims to grow at $ 7.3 trillion is likely to benefit from US FDI in Indian real estate.

With tactical investments including centers, Artificial Intelligence, and office space leasing, Indian real estate will rise to a new high. The present influx and incoming US investments will act as a whirlwind of sturdy contribution in Indian economy.

India-US trade deal portrays India as a magnet for global investments, mainly in the real estate sector.

You May Also Like: Top 10 Developers in Mumbai - Shaping the skyline of India’s Financial Capital

You May Also Like: Why Invest in Yamuna Expressway? What makes it a booming coordinate in 2025?

Looking for Long-Term Investme...