Budget 2026 | Real Estate expects Property Tax Reforms and higher Affordability Cap as major Decisions

Budget 2026 | Real Estate expects Property Tax Reforms and higher Affordability Cap as major Decisions

Budget 2026 | Real Estate expects Property Tax Reforms and higher Affordability Cap as major Decisions

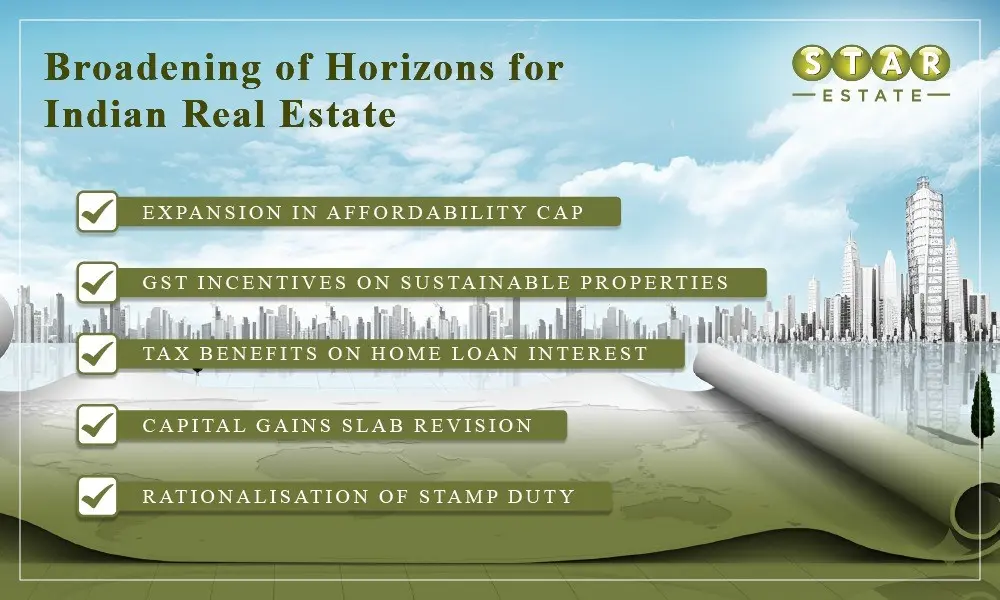

The Union Budget 2026 is a few days away, as it will be tabled on Sunday, February 1, 2026. Sunday is somewhat an unusual day for the annual announcement of the country’s financial roadmap. However, FM Nirmala Sitharaman is preparing to present her 9th consecutive budget speech as scheduled. Following this development, the Indian real estate sector is hopeful of receiving some benefits, including lower taxes, green incentives, and the much-awaited industry status.

Even before the approach of the Union Budget 2026, many challenges lie ahead for Modi Government 3.0. Including tariff and war scenarios as reasons for the economic slowdown. Amidst this, strategic partnerships are well-aligned with the goals of the Atmanirbhar and Viksit Bharat model. Interestingly, strategic decisions will reflect on how the Union Budget 2026 will impact the Indian real estate.

Despite being the choicest destination for global investors, India has a lot of policy framework to perform. After a significant cut in the RBI Repo rate, tax benefits on property purchase is another thing that the middle-class expects from the Union Budget 2026.

Impact of Budget 2026 on Indian Real Estate Sector

Indian real estate sector expectations from Budget 2026 are based on the fiscal policies introduced in 2025. Like GST reform 2.0, lowering taxability on cement and other construction materials makes the situation somewhat favourable for the property market. However, whether I need to pay higher GST on home buying still remains a question.

Will home prices come down after Budget 2026? Will affordable homes actually become affordable in 2026-27? The anticipation of the same will end once FM Nirmala Sitharaman tables her ninth consecutive Budget on the first day of February.

Industry Status

Amid the steady momentum of demand and supply, Indian real estate expects Budget 2026 to introduce more flexibility and mobility. The market veterans are once again optimistic about the sanction of industry status for Indian real estate. The fulfillment of this long-overdue demand will strategize transactions in the market. Thus, enhancing homebuyers, investors, and developers' confidence.

Property Tax Reform

Homeownership still remains an once-in-a-lifetime dream for families in the country. This reform is a pivotal under the list of Income Tax new slab expectations from Budget 2026. Thus, property tax reforms will be an anchor to unlock the dream home seamlessly.

Green Incentives

With the Modi Government focusing on sustainability, developers and end-users look forward to sustainable homes. However, the introduction of such properties requires a higher investment value. The green building incentives will help developers to incorporate sustainable features in residential projects. Such an incentive will stretch environment-friendly residential properties within the buyer’s reach.

Will GRIHA or IGBC-certified homes become cheaper? Will I be eligible for a tax concession on buying a green home? These are some questions homebuyers are struggling with. The disposal of subsidiary on green homes will act as a catalyst for Indian real estate growth in the coming time.

Budget 2026 and Real Estate Housing Sector Expectations

Fiscal support

According to reports, the Ministry of Corporate Affairs suggests the penetration of liquidity in the Indian real estate. The Ministry is likely to consider the introduction of a giant one-time microfinance credit guarantee scheme. It will address the requisites of NBFCs (Non-Banking Financial Companies) in the upcoming Budget.

The directive will strengthen NBFCs to disburse loans to the low-income segment, making affordable housing for all a better reality. The sanctioned amount is likely to be greater than 7,500 crore credit guarantees. It was credited during the pandemic and will possibly be driven by the State-run National Credit Guarantee Trustee Company (NCGTC).

Redefining Affordability

Forget about wealth creation. The entire nation is speculating about whether the middle-class be able to buy a home. Will the Union Budget 2026 offer a rebate on home buying? Will home loan interest attract a deduction under Section 80C? These questions arise from taxpayers' budget expectations.

The Indian real estate sector expects FM Nirmala Sitharaman to unbundle these worries by inducing several reforms. Including policy, structural, and property tax reforms. With the passage of time, the Affordable Housing Policy needs restructuring. The expansion of ticket size and budget under the policy is one of many real estate sector expectations from Budget 2026.

Home Loan Interest Deduction

India, racing ahead to be the third global economic power, needs to address it. The prices in the best Indian cities to buy properties are soaring high. Hence, will the Union Budget 2026 make the dream of home buying a reality? As a part of the Budget 2026 and real estate analysis, market veterans emphasize this step.

It will not only lower fiscal burden but will also help the Indian real estate to continue the momentum of bull rush. The direct curtailing of tax will strengthen buyers’ confidence and will give Indian real estate the much-needed push. The introduction of property tax reforms will nourish more value-based investments.

Budget 2026 and Luxury Real Estate Sector

The Indian real estate sector is witnessing a massive evolution. Rising from the demand for residential properties for end-users to wealth creators. A must to mention, penthouses and homes with expansive decks are the best real estate trends in 2025. Co-working spaces and retail spaces, offering a diverse portfolio for investment, strengthen the property market mood.

- With weapon and tariff wars becoming the baton of the new world, NRIs' interest in property buying in India has increased manifold. While some prefer to reinvest in residential real estate, new capital gains reforms can be a masterstroke in Budget 2026.

- What will be the major relief for taxpayers in the Union Budget 2026? All investors, including native and NRIs, look forward to FM Nirmala Sitharaman budget speech 2026. Amongst the seven longest serving finance ministers in India, she is the only woman minister to hold this portfolio in Indian history. Also, investors look forward to an exemption from tax on property buy and sell.

- Investment in immovable assets is the new vertical for wealth creators. Real estate expects a lowering of taxes on gift deeds and property transfers. The introduction of new tax slabs for the same will be one big positive blow to property investment in India in 2026-27.

The pandemic taught the realization of dedicated spaces for family members as new work patterns are infused in society. Thus, individuals prefer voluminous homes to address need of every member in the family. As a result, demand for luxury homes in top Indian cities surpassed earlier figures. The tax rebate, policy, and income tax slab reforms create a resourceful ecosystem.

The budget speech 2026 by FM Sitharaman on 01st February will only answer how many of the real estate expectations from Budget 2026 are fulfilled. Also, the same will shape the future of the Indian property market along with that of homebuyers and investors.

Bangalore continues to dominat...