How Repo Rate Cut will impact Home Loan Borrowers – Know in Detail

RBI Monetary Policy Rate Cut – Home Loan Benefits

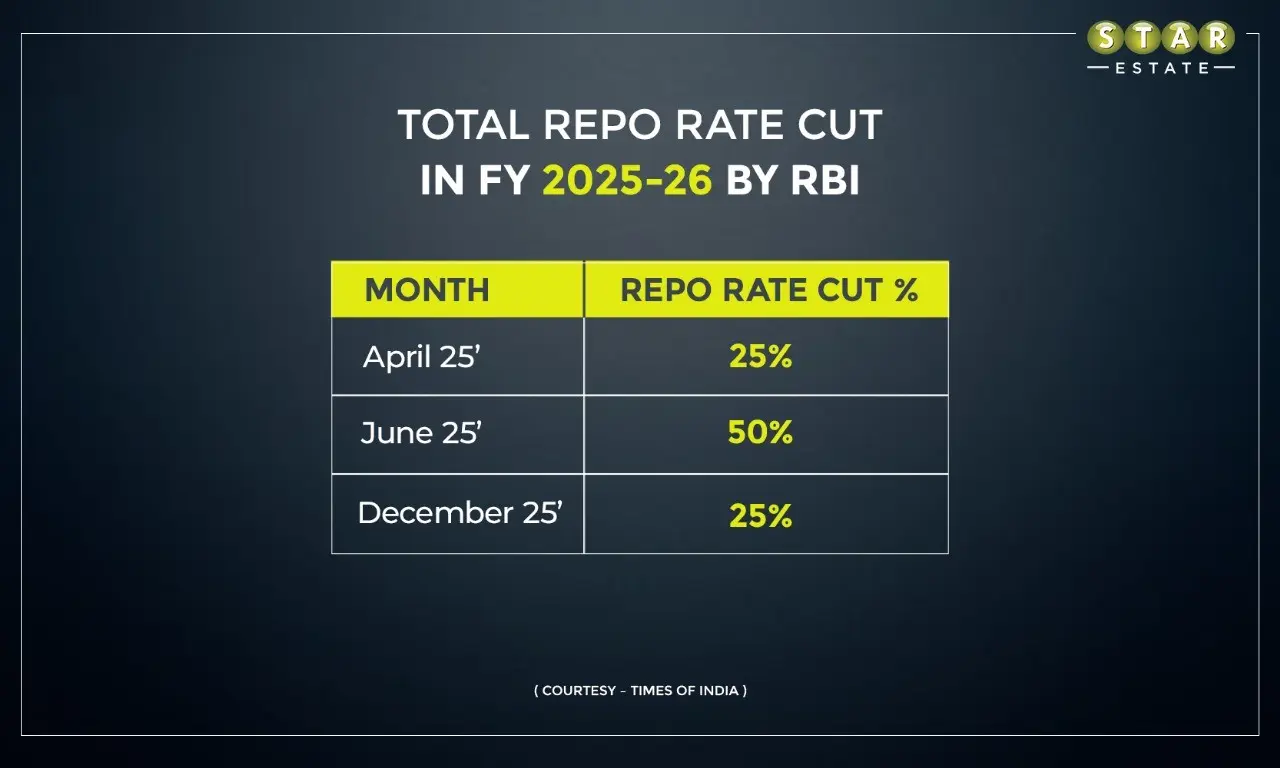

RBI Monetary Policy Rate Cut – Home Loan BenefitsIn FY 2025-26, the RBI repo rate cut continues, as the establishment slashes the repo rate by 25 basis points once again. The latest repo rate stands at 5.25%. The decision was taken unanimously at the RBI Monetary Policy Meeting (MPC) held on December 04th, 2025.

It also increases speculation about will home loan get cheaper now. The rate cut will positively impact home buyers and existing loan borrowers. After the post-RBI announcement, banks start rate alteration to press maximum benefit for consumers.

Going by its pattern of repo rate cut in 2025-26, it is a sturdy move to strengthen the buying capacity of varied segments of society. Including the affordable and mid-segment homebuyer.

The soaring real estate demand in India amplifies apprehensions about thoughtful monetary investment. Also, the current stream of RBI rate cut boosts homebuyers' confidence, particularly first-time buyers.

However, market veterans suggest that property buyers align their purchase decision with a stable financial condition. Also, homebuyers must channelize steady income generation.

The RBI repo rate cut decision was taken in the 3-day Monetary Policy Committee (MPC) meeting. The meeting was held on 03rd, 04th, and 05th December to review the economic scenario.

Sanjay Malhotra, Governor, Reserve Bank of India, said that repo rate deduction is a unanimous decision taken after a vote on the policy action. Also, inflation, growth, and liquidity requirements are a few parameters taken into consideration while deciding.

RBI takes Liquidity Measures to Support Financial Markets – Latest on RBI Monetary Meet

“The MPC met on 03rd, 04th and 05th of December to deliberate and decide on the policy repo rate. After a detailed assessment of the evolving macroeconomic conditions and the outlook, the MPC voted unanimously to reduce the policy repo rate by 25 basic points to 5.25% with immediate effect.”, Malhotra said.

Along with this, the Standing Deposit Facility (SDF) rate is also brought down to 5 per cent. While the Marginal Standing Facility (MSF) and Bank Rate stand at 5.5%. The Reserve Bank of India keeps it unchanged.

After the 3-day review, RBI float liquidity measures as an aid to financial markets. “The Reserve Bank has decided to conduct OMO purchases of Government securities of Rs. 1lakh crore and a three-year dollar rupee buy-sell swap of 5 billion US dollars this month in December to inject further durable liquidity into the system,” Malhotra said.

Also Read: India Real Estate likely grow worth $10 Trillion by 2047: Report

What is the impact of the RBI Repo Rate Cut on Home Loan EMIs?

Amid all this, curiosity to know will home loan get cheaper now remains at its peak. Keeping in mind the slashing rate cut from April 2025 to date, homebuyers remain optimistic with EMI deductions.

Also, a property expert remains positive about the decision taken in the RBI Monetary Policy meeting in December 2025. With less than a month remaining for the year-end, the decision to lower the repo rate brings joy to the property market. The timing of this decision will reflect in profitability, as the country is experiencing high demand for immovable assets.

Assessing the trend, luxury home demand will increase, and high sale figure is expected from the segment. The EMI reduction is the major reason here, as many investors in and wait-and-watch situation are likely to make a deal closure.

Also, the quick passing of the rate cut benefit to home loan borrowers will eventually work for the market. The rise in housing prices by approximately 10% in the top Indian cities in 2025 is likely to continue. The affordable segment rise will majorly witness a rise from the repo rate cut decision.

Home Loan Interest Rates in India – What Should Existing Home Buyers Do Now?

With every repo rate change, existing homebuyers come across one big question? Will the new RBI repo rate cut reduce home loan EMIs?

Also Read: GST Bachat Utsav – How RBI Repo Rate Cut and Next Gen GST unlocks Dream Home

A smart way to wealth creation is to balance home loan EMIs and loan tenure. According to an expert, existing home loan borrowers can ask banks to lower the tenure instead of increasing the EMI value. The move is feasible as the EMI, along with curtailing the principal amount, also deducts the interest rate.

In the current year, the Reserve Bank of India lowered the repo rate three times. In April, June, and December, for 25%, 50% and 25%, respectively. If you are thinking about refinancing a home loan after the fresh RBI repo rate cut, here are things to consider.

The repo rate change reflects mainly between 30-60 days. Thus, wait for a few days to decide on changing loan lender; Switch only if the basic point difference is between 50-70 basic points. Also, check if the loan amount and tenure turnaround are positive by refinancing the home loan.

Economic Survey 2026 backs Tec...